Everything has a price tag attached to it. Some are overt, such as the price tag on your new clothes. Some of them are concealed, such as restless nights after submitting an MBA admission application. Whatever the case may be, you will have to pay the price, especially In a war-like situation, where both parties have to pay the price.

Civilians' lives, firearms, ammo, tanks, and fighter aircraft are examples of actual costs of war. However, these wars must be financed using the capital available to a country, and someone has to pay to keep the war machine running.

Certain Russian banks have been delisted from the SWIFT financial transaction system by the United States, the European Union, the United Kingdom, Canada, Japan, and other nations.

But what is SWIFT, you may ask? The Society for Worldwide Interbank Financial Telecommunication, or SWIFT, is a global communications system for banks and other financial organisations. It does not transport money directly, but it sends instructions for sending and receiving particular funds.

There are solutions other than SWIFT, such as the banks using other messaging methods like apps or email, but those transactions are unlikely to be as safe. They may wind up being slower and more expensive.

But the colossal hammer in the toolshed was about to come...

The Biden administration imposed sanctions on Russia's Central Bank on Monday last week, prohibiting U.S. dollar-denominated transactions and aiming to essentially wipe out Moscow's $630 billion foreign currency war chest, which the Kremlin hoped would protect the Russian economy from other sanctions imposed by Western nations.

Several financial restrictions were targeted at freezing any residual US-based assets owned by the Russian Central Bank in the U.S. or by Americans in other countries.

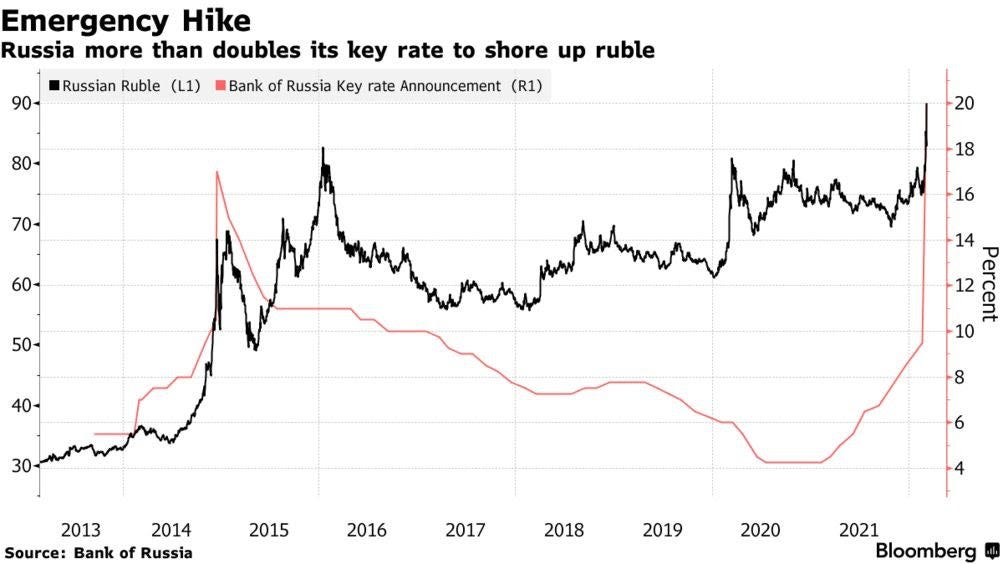

Foreign reserves are typically utilised to support currencies in times of severe market volatility. But once there are sanctions on using the underlying currency which support these reserves, a plunge has to happen. This is what we saw with Rubble after the funds got frozen.

The Russian central bank quickly doubled its interest rates to staunch the bleeding.

Russia raised interest rates to encourage capital into the nation. Um, but Russia, is it even possible when all the asset and product flows are entirely stopped? Who will send money to Russia to earn 20%APR? RIP Interest Rate Parity

This whole situation makes me wonder why we even have foreign currency reserves in the first place...